October 30, 2023 – Eastman Chemical Company released its third quarter 2023 financial report.

● Operating activities generated more than $500 million in cash in the third quarter, supported by strong measures to reduce inventory

● Although demand remains weak, sales/product mix continue to improve slightly in several key end markets such as consumer durables and personal care

● Continue to promote full-year cost structure optimization projects exceeding US$200 million (net of inflation)

● Continue to advance the Kingsport Methanol Decomposition Unit project, which is expected to be put into operation and generate revenue by the end of the year

Eastman Chairman and CEO Mark

Costa said: “The performance of the third quarter proves that the powerful measures we have taken to significantly reduce inventory and prioritize strong cash flow have achieved remarkable results. Demand in many key end markets remains weak and the trend of destocking continues. , we achieved strong cash flow. We are encouraged by the slight improvement in demand in markets such as consumer durables and personal care, but the recovery is slower than expected. We insist on doing controllable things, including strictly controlling costs, Protecting product value through flexible pricing measures and managing working capital. These measures give me confidence in the resilience of our product portfolio and the future sustainability of our strong cash flows. Also exciting is the launch of our Kingsport Methanol The decomposition unit will be put into operation and generate revenue by the end of the year. This will further consolidate Eastman’s leading position in the circular economy.”

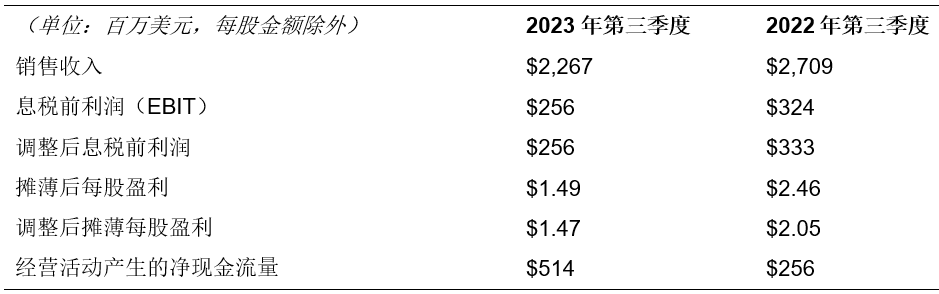

Comparison of consolidated financial results for the third quarter of 2023withthe third quarter of 2022

Sales revenue fell 16% due to an 11% decline in volume/product mix and a 5% decline in selling prices.

Volume/mix declined across most product lines due to continued weakness in underlying demand in several end markets such as consumer durables, building and construction, agriculture and healthcare, as well as continued destocking trends among customers. Lower sales prices in the chemical intermediates, additives and functional materials businesses more than offset the favorable impact of higher sales prices in the fiber business.

The decline in EBIT was due to lower volumes/product mix, lower capacity utilization to boost cash flow growth, higher pension expenses and unfavorable currency effects. The impact of these headwinds was partially offset by lower variable costs that more than offset lower sales prices, coupled with benefits from cost-cutting measures.

Comparison of the performance of each business in the third quarter of 2023andthe third quarter of 2022

Specialty Materials-Volume/product mix declined 17%, resulting in a 16% decline in sales revenue.

Compared with the second quarter of 2023, demand in the specialty plastics end market has improved, but the end markets represented by durable consumer goods, medical and consumer goods have not yet recovered from weak demand. In addition, customers’ destocking trend has intensified, so sales volume / Product portfolio fell 26% year-on-year.

The decrease in EBIT was due to lower sales volume/product mix, a significant reduction in capacity utilization to facilitate cash flow growth, and unfavorable currency effects. These headwinds were partially offset by continued declines in variable costs.

Additives and Functional Materials-Volume/product mix decreased by 18% and sales price decreased by 9%, resulting in sales revenue falling by 26%.

Sales volume/product mix declined across the business due to weak demand in end markets such as building and construction, as well as increased destocking trends among customers in the agricultural end market. The main reason for the decrease in sales price is the cost pass-through agreement.

The decrease in EBIT was due to lower sales volume/product mix and lower capacity utilization to promote cash flow growth. Lower variable costs more than offset lower sales prices, partially offsetting the impact of these headwinds.

Fiber-Sales price increased by 28%, driving sales revenue to increase by 29%.

The main reason for the sharp increase in the sales price of acetate fiber tow is the increase in industry capacity utilization and the increase in raw material, energy and distribution prices throughout 2022.

The increase in EBIT was mainly due to the recovery in profit margins, which was facilitated by higher sales prices that returned EBIT margins to acceptable performance levels.

Chemical Intermediates – Sales price decreased by 19% and volume/product mix decreased by 2%, resulting in sales revenue falling by 21%.

Represented by olefin products, the main reason for the decline in sales price and sales volume/product mix is weak demand in the end market.

The decline in EBIT was mainly due to declines in sales volume/product mix and capacity utilization, as well as narrowing interest margins.

Cash flow

Cash generated by operating activities was $514 million in the third quarter of 2023, compared with $256 million in the same period last year. The strong cash flow growth was mainly due to the significant inventory reduction. In the third quarter of 2023, the company returned $94 million to shareholders through dividends. Available cash in 2023 will be prioritized for organic growth investments and payment of quarterly dividends.�, bolt-on acquisitions, share repurchases (to offset share dilution) and net debt reduction.

2023Outlook

When talking about the outlook for the full year of 2023, Costa said: “Although the global economic environment remains challenging, we still achieved our profit and cash flow expectations in the third quarter. This achievement is due to the continued progress we have made across our entire product portfolio.” We are pursuing a rigorous pricing strategy, strong performance in our fiber business, and strong measures to promote strong cash flow growth. In addition, we are continuing to advance more than $200 million (net of inflation) of full-year cost structure optimization projects. Entering the fourth quarter, Demand remains subdued as customers remain cautious in the current challenging environment. At the same time, we expect normal seasonal fluctuations in key end markets such as building and construction, consumer durables, and performance automotive films. We will also continue to take strong measures , to promote cash flow growth. Taken together, we expect earnings per share in 2023 to be between $6.30 and $6.50, and operating cash flow in 2023 to be close to $1.4 billion.”

微信扫一扫打赏

微信扫一扫打赏