A few days ago, the four major private petrochemical companies – Hengli Petrochemical, Dongfang Shenghong, Hengyi Petrochemical, and Rongsheng Petrochemical have successively released their financial reports for the third quarter of 2023. Overall, the performance of the four companies Net profit increased significantly, but it dropped significantly compared with the same period last year. Data show that in the first three quarters of this year, the four private petrochemical companies had a total operating income of 462.805 billion yuan and a total net profit of 9.62 billion yuan. In the first three quarters of 2022, the total operating income of the four companies was 565.532 billion yuan.

, with a total net profit of 14.422 billion yuan.

Hengli Petrochemical: Turned losses into profits in the third quarter!

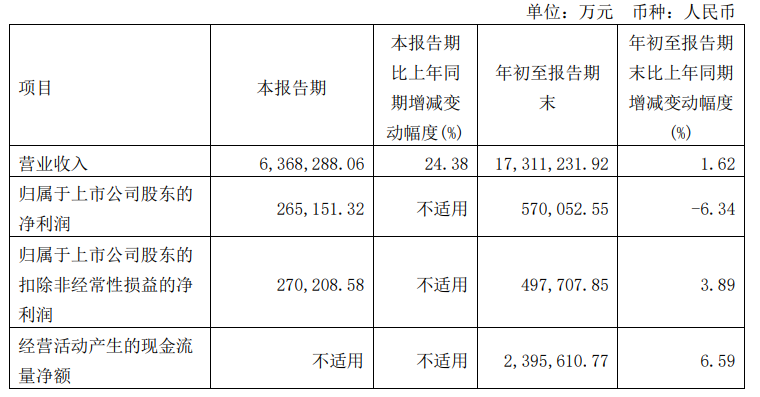

On the evening of October 27, Hengli Petrochemical announced its third quarterly report for 2023. In the first three quarters, the company achieved operating income of 173.112 billion yuan, net profit attributable to shareholders of listed companies of 5.701 billion yuan, and operating cash flow of 23.956 billion yuan. Among them, from the first to the third quarter, the company achieved profits of 1.02 billion yuan, 2.03 billion yuan and 2.65 billion yuan respectively, showing a good momentum of continuous improvement quarter by quarter.

During Q3, the company’s sales of refining products/PTA/new material products were 533/387/1.08 million tons respectively, down 1%/up 36%/up 14% from the previous quarter, and the average selling prices were 5733/5088/8435 yuan/ tons, respectively increased by 7%/decreased by 2%/basically remained the same month-on-month.

Since the beginning of this year, the industry has maintained a good prosperity. Hengli Petrochemical’s price spreads of refining and chemical products have improved significantly: strong products such as PX and refined oil have benefited from the improvement of global supply and demand fundamentals and the support of downstream demand, and their profits are better and remain stable. Sales; the olefin industry chain has benefited from the marginal improvement of real estate policies and the accelerated pace of domestic infrastructure construction, and has gradually emerged from the industry trough; with the recovery of terminal consumption, the profitability of the downstream polyester new materials business has also accelerated its recovery. As the country continues to implement a series of macroeconomic policies and measures to stabilize growth and promote development, my country’s economy is expected to continue its recovery trend, and company performance will continue to recover.

Based on the industry’s unique large-scale chemical development platform with deep integration of “oil, coal and chemicals”, Hengli Petrochemical continues to implement the established development strategy of “making the upstream bigger and the downstream stronger”, deeply anchoring high-tech barriers, high-tech A high-growth track with added value, actively build the “Dalian Changxing Island” fine chemicals and new materials industry chain ecosystem, and strive to build a platform-based leading enterprise in the R&D and manufacturing of new chemical materials industry chain.

The company will also continue to promote the layout and key projects of downstream fine chemicals and new chemical material products, including high-end fine chemical parks, optical films, lithium battery separators, battery electrolytes, composite current collector base films, photovoltaic backsheet base films, etc. construction. As the national policy of stabilizing growth continues to be implemented, industry demand continues to recover, and various fine chemical and new material projects under construction are accelerated to put into production and create profits, the company is expected to achieve a substantial increase in profitability in the future.

Hengyi Petrochemical: Profit continues to improve in the third quarter

On the evening of October 27, Hengyi Petrochemical disclosed its third quarter report for 2023. The report shows that Hengyi Petrochemical achieved a total operating income of 101.529 billion yuan in the first three quarters of 2023, and a net profit attributable to shareholders of listed companies of 206.2905 million yuan, of which the net profit attributable to shareholders of listed companies in the third quarter was 130.2082 million yuan, compared with the second quarter An increase of 215.76%.

Since entering the third quarter, the crack spread of refined oil products in the Singapore market has continued to rise. Since the beginning of August, the diesel crack price spread in Singapore has climbed to a high of about US$30/barrel, and the overseas refined oil market continues to be booming, which has supported the company’s performance. According to the company, Hengyi Petrochemical will actively implement the technical transformation of the Brunei refining and chemical project in 2023, and the technical transformation work has been completed in the first half of the year. After the technical transformation was completed, the company further increased the proportion of diesel output in an effort to maximize profits.

Since entering the third quarter, the polyester sector has continued to improve month-on-month, the operating rate of the polyester industry has gradually increased, and the operating load rate has returned to 90%. According to the Galaxy Futures report, under the expectation of the peak season of the Golden Nine and Silver Ten, the average monthly polyester operating rate in the third quarter was 92.58%, a month-on-month increase of 3.22%, and the average monthly polyester output was 6 million tons, a month-on-month increase of 7.8%. The downstream textile and clothing market is ushering in the traditional peak consumption season, the domestic economy is recovering steadily, and polyester filament inventories remain low. According to CCF data, FDY inventory days were as low as 10.3 days in September, and POY inventory days were as low as 10.8 days. The steady growth in demand has led to an improvement in the profits of polyester filament and staple fibers, and the overall weighted profit of polyester has maintained a good level.

From the supply side, old and backward equipment and production capacity lacking technological innovation capabilities will gradually withdraw from industry competition. In the future, the clearance of backward production capacity will be further accelerated, the industry entry threshold will be further increased, and the market concentration of the polyester industry will also be advanced optimization. As a leading enterprise in the industry, the company is expected to continue to leverage its advantages of scale, technological innovation and industrial integration.

Hengyi Petrochemical stated that as a leading private multinational enterprise integrating refining and chemical fiber, the company has built a columnar industrial structure integrating upstream, midstream and downstream industrial chains. In the future, the company will…Further enhance the integration and refinement advantages of the industrial chain, stimulate the contribution of technological innovation to the company’s main business, and give full play to the advantages of leading enterprises in the coordinated operation of upstream and downstream industries.

Oriental Shenghong: Q3 net profit soared 1457.58%

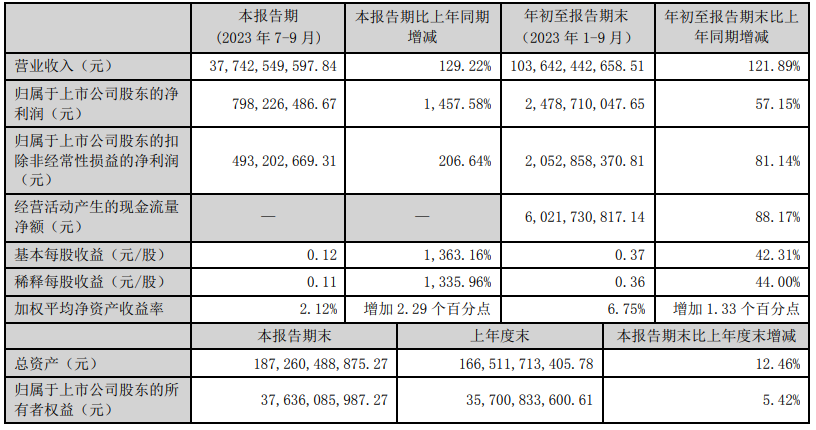

On October 28, Oriental Shenghong released its third quarter report for 2023. The report shows that in the third quarter of 2023, the company’s main business income was 37.743 billion yuan, a year-on-year increase of 129.22%; the net profit attributable to shareholders of listed companies in the third quarter was 798 million yuan, a year-on-year increase of 1457.58%, and the performance reached a record high.

In the third quarter of this year, although the petroleum processing industry showed a bottom rebound trend, it is still in a relatively sluggish stage.

Judging from the latest operating data announced by Dongfang Shenghong, the company’s performance has continued the good trend in the first half of the year. On the one hand, the company achieved operating income of 37.743 billion yuan in the third quarter, a year-on-year increase of 129.22%; net profit attributable to the parent company was 798 million yuan, a significant year-on-year increase of 1457.58%, achieving a record high in single-quarter revenue; on the other hand, the company In the first three quarters, the main business revenue reached 103.642 billion yuan, achieving a historic breakthrough, and the total revenue scale entered the 100 billion yuan level for the first time.

Industry insiders said that the full commissioning of the 16 million tons/year Shenghong refining and chemical integrated project built at the Lianyungang petrochemical base is the main driving force for the company’s outstanding performance this year. It is understood that the Shenghong Refining and Chemical Project started construction in December 2018. After a four-year construction cycle, the Shenghong Refining and Chemical Project was completed in December 2022, opening up the entire refining and chemical integration process and quickly achieving capacity and load ramping. and stabilize production operations. After Shenghong Refining is fully put into operation in the first half of 2023, it will achieve operating income of 47.058 billion yuan and operating profit of 2.369 billion yuan in the first half of the year.

In addition, it is understood that the 150,000 tons/year carbon dioxide to green methanol project, a demonstration project of Dongfang Shenghong’s green carbon-negative industry chain, will be completed and put into operation at the end of September 2023. The company’s Hubei Higgs lithium battery new material project with a total investment of 18.6 billion yuan will also have an annual production capacity of 500,000 tons of iron phosphate and 300,000 tons of lithium iron phosphate in the future. This project is the core project of Shenghong’s lithium battery new material industry layout. After completion, it can achieve an annual output value of 27.8 billion yuan and a tax revenue of 1.2 billion yuan. At present, the first phase of 100,000 tons of iron phosphate and 100,000 tons of lithium iron phosphate and supporting equipment have also entered the construction stage in September.

It is worth mentioning that Rongsheng Petrochemical, another private refining and chemical giant, also achieved a surge in net profit attributable to shareholders of listed companies in the third quarter.

Rongsheng Petrochemical: Q3 performance improved significantly

On October 26, Rongsheng Petrochemical announced its third quarter results for 2023. The company achieved operating income of 84.522 billion yuan, a year-on-year increase of 9.07%; net profit attributable to shareholders of listed companies was 1.234 billion yuan, a year-on-year increase of 1367.00%; Shareholders’ net profit after deducting non-recurring gains and losses was 1.258 billion yuan, a year-on-year increase of 693.76%. Performance was better than expected.

The 1,367% surge in net profit seems to confirm this statement from the side, but it is worth mentioning that the decline in Rongsheng Petrochemical’s performance in the first half of this year was mainly due to falling raw material and product prices and shrinking market demand.

Rongsheng Petrochemical currently operates the world’s largest monomer refinery and needs a stable supply of crude oil. Recently, Saudi Aramco announced that it has signed a cooperation framework with Jiangsu Oriental Shenghong Co., Ltd. (hereinafter referred to as “Oriental Shenghong”) Agreement to promote discussions on Saudi Aramco’s possible acquisition of a 10% strategic stake in Jiangsu Shenghong Petrochemical Group Co., Ltd. (hereinafter referred to as “Shenghong Petrochemical”), a wholly-owned subsidiary of Oriental Shenghong. With Saudi Aramco’s strategic investment in stocks, the stability of upstream raw materials will be greatly improved.

In addition, the price difference of overseas refined oil products will widen during Q3 of 2023, while the price difference of domestic refined oil products will generally fall during the same period. Against this background, the Ministry of Commerce issued the third batch of refined oil export quotas for the year on September 1. Rongsheng The export quota of 1.06 million tons was once again obtained, bringing additional contribution to the performance of the refined oil segment, which will also support the company’s Q4 performance.

At the same time, the current large refining and chemical industry has entered the performance recovery channel. Rongsheng Petrochemical’s high value-added devices are gradually put into production this year and the smooth progress of new material projects has also contributed to the company’s net profit to achieve quarter-on-quarter improvements for three consecutive quarters. Relying on refining and chemical assets, the company extends downstream to develop a number of new energy and new material products such as EVA, DMC, PC, and ABS. The total investment scale exceeds 200 billion yuan, of which high-performance resin projects and high-end new material projects have started construction. The preliminary work of the Jintang project and the Taizhou project is being carried out in an orderly manner.

Continued growth is expected in the fourth quarter

Specifically, in the first three quarters of this year, among the four major private petrochemical companies, Hengli Petrochemical ranked first in operating income, reaching 173.112 billion yuan; followed by Dongfang Shenghong, Hengyi Petrochemical, and Rongsheng Petrochemical, with respectively 103.642 billion yuan, 101.529 billion yuan, 84.522 billion yuan.

It is worth noting that in the first three quarters of last year, the net profits of the four major private petrochemical companies all declined. This year, with the widening of overseas refined oil price differentials and the overall decline in domestic refined oil price differentials during the same period, except for Hengyi Petrochemical Net In addition to the continued decline in profits, the net profits of the other three companies have improved.

Looking forward to the fourth quarter, the four companies also have expectations, and the product side may be able to release some potential.

With the overall decline in the price difference of refined oil products, except for Hengyi Petrochemical’s net profit, which continued to decline, the net profits of the other three companies have improved.

Looking forward to the fourth quarter, the four companies also have expectations, and the product side may be able to release some potential.

微信扫一扫打赏

微信扫一扫打赏