The demand for buffered oxide etchants (BOE) is growing rapidly and market competition is intensifying.

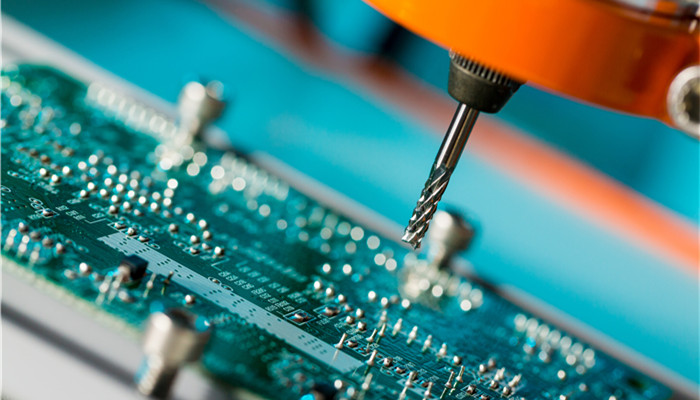

Buffered oxide etchant (BOE), also known as buffered oxide etchant, is a mixture of hydrofluoric acid (49%) and water or ammonium fluoride and water. As a wet etchant, buffered oxide etchant has the characteristics of fast rate, easy etching control, and high dissolution capacity. Buffered oxide etching solution is mainly used to etch silicon dioxide (SiO2) or silicon nitride (Si3N4) thin films. Its downstream applications involve photovoltaic solar energy, semiconductors, flat panel displays and other fields.

According to the “2021-2025 China Buffered Oxide Etch (BOE) Market Feasibility Research Report” released by the Industrial Research Center In recent years, thanks to the rapid development of new energy, electronics and other industries, the global buffer oxide etching liquid market has continued to expand. By 2020, the global buffer oxide etching liquid market has reached 420 million yuan. At present, the downstream market of buffered oxide etching solutions is in the development stage, and the demand for buffered oxide etching solutions still maintains a growth trend. Therefore, the development prospects of the buffered oxide etching solution industry are good in the future.

Globally, the buffer oxide etching liquid market is mainly concentrated in North America, Asia-Pacific, and Europe. Among them, the buffer oxide etching liquid market in the Asia-Pacific region is growing rapidly. In this region, China, Japan, and South Korea are the buffer oxide etching liquid markets. Major players in the liquid market. In recent years, with the shift of global industries to the east, the scale of my country’s semiconductor, flat-panel display and other industries has continued to expand, which has provided broad space for the development of the buffered oxide etching solution industry.

From the perspective of market competition, buffer oxide etching solution manufacturers are mainly distributed in Europe, the United States, Japan, South Korea, China and Taiwan. Related manufacturers include BASF of Germany, Kanto Chemical Company, Arch Chemicals of the United States, Mitsubishi Chemical, Zhejiang Kaisheng Fluorine Chemicals, Jiangyin Jianghua Microelectronics Materials, Formosa Plastics Daikin Precision Chemical Co., Ltd., Jiangyin Runma Electronic Materials, etc.

Relying on advantages such as quality, brand, and technology, foreign companies still occupy a major share of the high-end buffer oxide etching solution market. Currently, there is a certain gap between Chinese mainland companies and international companies, and there is still considerable room for improvement for domestic companies in the future. From the perspective of future industry development trends, buffered oxide etching solutions are closely related to downstream industries. The development of the downstream market will inevitably require the upgrading of buffered oxide etching solutions to continue to accelerate. In the future, industry development will continue to be new, high-end, environmentally friendly, etc. Directional upgrade.

Industry analysts said that in recent years, with the development of display panels, semiconductors, solar cells and other industries globally and in my country, buffer oxidation The market demand for etching solutions continues to increase, and the industry has good prospects for future development. There are a large number of buffer oxide etching solution manufacturers, and market competition is intensifying. As market demand escalates, companies with strong R&D capabilities and high-end product production capabilities will have more competitive advantages in the future.

微信扫一扫打赏

微信扫一扫打赏