Around the Spring Festival of 2020, due to the new coronavirus epidemic first broke out in China, which greatly suppressed the domestic downstream consumption, the market demand was sluggish, and some HDI factories chose to reduce the load, so that the market price of HDI trimer was supported at around 38,000-39,000 yuan per ton. in the middle of 2020, the low season of HDI curing agent came, and the price further fell to around 35,000, which lasted until September. The price lasted until September. after September, due to the tight supply of adipic acid, coupled with the downstream demand has picked up, curing agent prices began to rise all the way to the end of 2020, HDI trimer part of the bulk offer in the 50,000-60,000 yuan / ton or so.

Market trend in 2021:

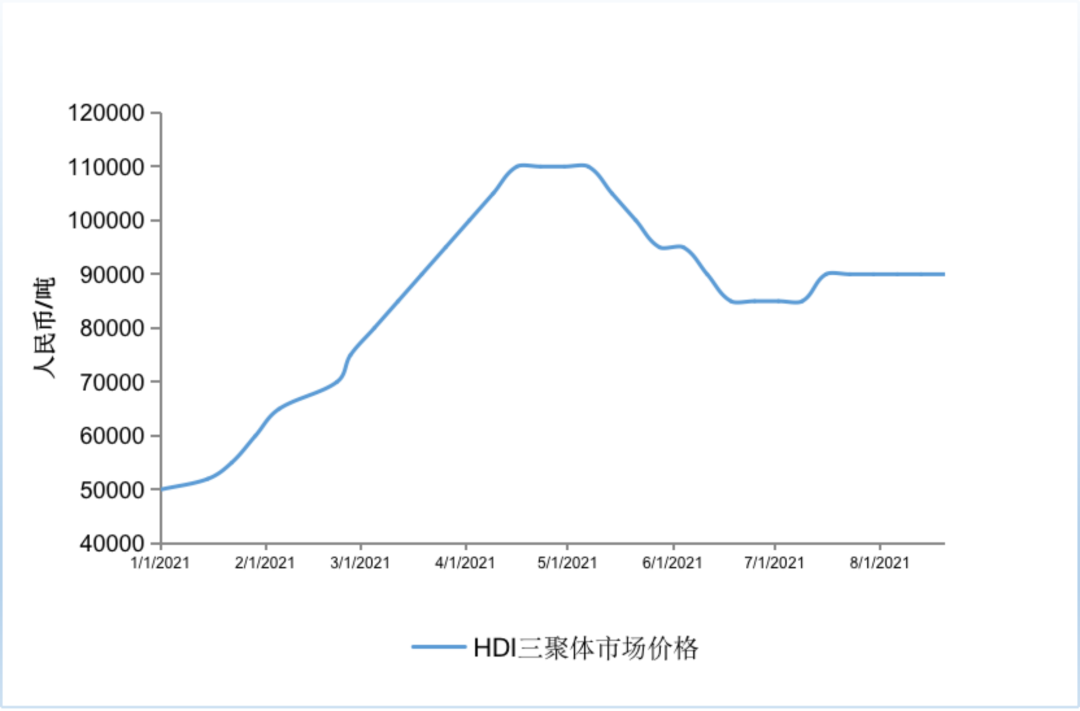

Picture

Into 21 years, HDI supply tension not only did not improve, but also intensified.

On January 11, Germany’s Costron announced that HDI products suffered force majeure due to a fire in supplier-related equipment.

February 16, by the extreme cold weather, located in the United States of America, Texas, INVISTA two adiponitrile and two adipic diamine plant, and is located in Texas around the state of Alabama, OLSD adiponitrile and adipic diamine plant at the same time seriously affected, the two adipic diamine giant at the same time declared force majeure. These plants occupy 65% and 50% of the global adiponitrile and adiponitrile diamine production capacity respectively, the global adiponitrile diamine supply situation is very serious, and the road to restart is long. Adipic diamine is the most important raw material for the production of HDI series products, and the supply of adipic diamine suffered a heavy blow, and the suppliers are under great pressure both in terms of cost and supply.

After the year part of the downstream coating enterprises gradually resume production, the demand for further warming, but due to the shortage of raw materials, suppliers are cautious offer, the volume of transactions shrinking, the intermediary holding very limited supplies, low prices and selling intentions obvious, bulk offer to 60000-70000 yuan / ton or so, the market price has a strong upward trend. To the beginning of April, the price of HDI trimer on the secondary market has exceeded 100,000 yuan / ton. Under the impact of the rapid rise in HDI curing agent prices, the downstream demand, which had been gradually warming up, turned light and seemed to inhibit the trend of price increases.

However, on April 21, BASF said, the company received a force majeure notice of raw material suppliers, HDI product supply or will further tighten, between this force majeure, HDI prices high again to get support, the market price of 100,000 ~ 110,000 yuan / ton near the side plate for nearly a month, and the secondary market is difficult to find a goods.

May 12, Germany COST announced force majeure lifted, the protracted supply shortage has finally been eased, at the same time due to the high level of downstream demand has been suppressed, HDI market prices gradually fell, to the beginning of July, HDI triple polymer market prices fell back to 80000 yuan / ton neighborhood.

In July, due to Germany BASF’s raw material supplier Butachimie was scheduled to be lifted at the end of June force majeure will continue until the end of September, Japan Asahi Kasei HDI device overhaul, domestic HDI production capacity of the largest chemical HDI device has also begun a large-scale overhaul, HDI market prices rose again to the beginning of August, has been back to a high level of 90,000 yuan / ton.

Market forecast for the second half of the year:

From the demand side, 21 years since the beginning of the year, chemical raw material prices continue to rise, resulting in the cost of coatings enterprises straight up, the coating industry’s main raw materials in the cost of more than 80%, and the various coatings companies have also tried to pass on the cost pressure by means of price increases one after another. But the paint industry concentration compared to adipic acid and HDI and other raw materials is weak, cost conduction is slower, especially small customers and other retail price negotiation ability is poor, profit margins are further squeezed, the production willingness is low, the industry’s overall growth rate is weak down. But looking ahead to the second half of the year, the United States fiscal policy is positive, global liquidity is abundant, inflation is high; the smooth recovery of the European economy will also be to a certain extent to pull domestic exports; domestic infrastructure is expected to speed up in the second half of the year, consumer goods inflation is still slowly moving upward, the PPI in the second half of the year will still be at a high level, it is expected that the second half of the year, especially brand-name coatings manufacturers growth rate will remain strong, and the supply side of the shortage of adiponectin is difficult to short-term situation Fundamental solution to the supply side of the shortage of adipic acid in a short period of time is difficult to solve, under this supply and demand relationship, HDI market is expected to remain high in the second half of the year.

微信扫一扫打赏

微信扫一扫打赏