On November 8, according to the website of the China Securities Regulatory Commission, the China Securities Regulatory Commission received a report from the Shenzhen Stock Exchange regarding the initial public offering of shares of Nanjing Kent Composites Co., Ltd. (hereinafter referred to as “Kent Shares”) and its entrepreneurial plans. Review opinions and company registration application documents for board listing.

According to relevant regulations, after reviewing the Shenzhen Stock Exchange’s review opinions and company registration application documents, the China Securities Regulatory Commission approved Kent Shares’ registration application for the initial public offering of shares. This issuance of shares shall be implemented in strict accordance with the prospectus and issuance and underwriting plan submitted to the Shenzhen Stock Exchange. The approval is valid for 12 months from the date of approval of registration. From the date of consent to registration to the end of this stock issuance, if any major event occurs to the above-mentioned company, it shall report it to the Shenzhen Stock Exchange in a timely manner and handle it in accordance with relevant regulations.

Kent Shares’ public issuance of no more than 21.03 million A shares is expected to raise 352 million yuan, of which 173 million yuan will be used for parts expansion projects such as seals and structural parts; 63.2 million yuan will be used for PTFE membrane expansion projects production project; 44.02 million yuan will be used for the corrosion-resistant pipe fittings expansion project.

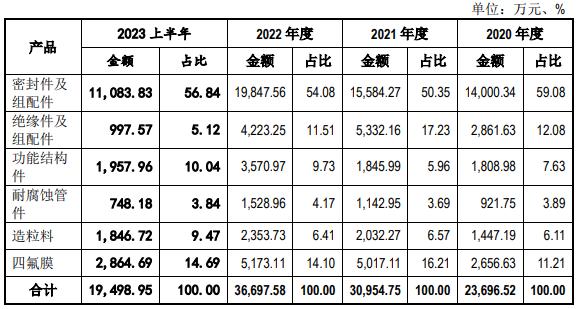

Kent Co., Ltd. focuses on the research and development, production and sales of high-performance engineering plastic products and components. The company’s main products include six categories: seals and components, insulation components and components, functional structural parts, corrosion-resistant pipe fittings, granulated materials and PTFE membranes. Among them, seals and components account for a relatively high proportion of revenue.

According to its prospectus, Kent’s revenue from seals and components in the first half of 2023 was 111 million yuan, accounting for 56.84% of its total revenue.

During the reporting period, the company mainly purchased PTFE and other fluoroplastic raw materials, PEEK and other raw materials. The company’s important suppliers include Shandong Dongyue Polymer Materials Co., Ltd., Zhonghao Chenguang Chemical Research Institute Co., Ltd., etc.

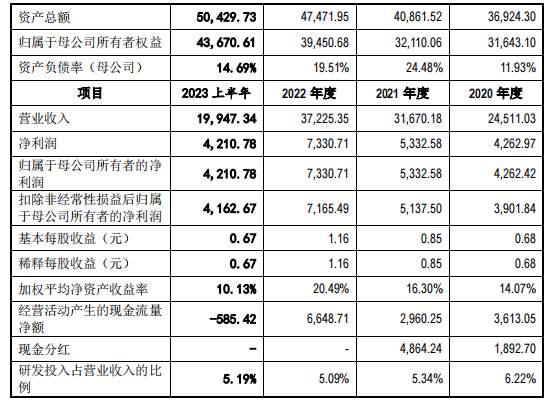

In terms of performance, from 2020 to 2022 and the first half of 2023, the company’s operating income was 245.1103 million yuan, 316.7018 million yuan, 372.2535 million yuan, and 199.4734 million yuan respectively; net profits were 42.6297 million yuan, 53.3258 million yuan, 73.3071 million yuan, 42.1078 million yuan, with a net profit margin of around 20%.

From the perspective of customers, they are mainly CommScope, Bray, Emerson, Rego, Schlumberger, China Railway Research Institute, CRRC, Neway Corporation, Aerospace M&G, BYD, etc. In recent years, the sales revenue of the top five customers accounts for the proportion of current operating revenue. They are 42.83%, 40.25%, 41.61% and 35.79% respectively.

With the development of domestic industries such as new energy vehicles, 5G communication technology, and “two new and one important” (new infrastructure construction, new urbanization construction, transportation, water conservancy and other major engineering construction), the demand for high-performance materials continues to grow.

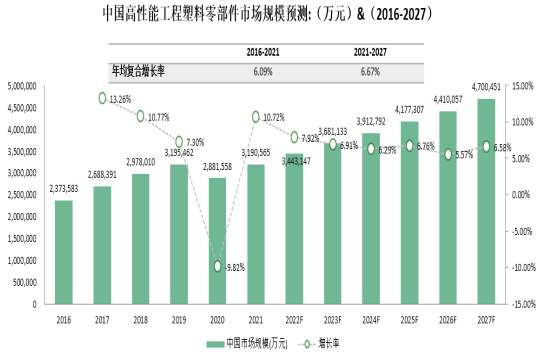

In the prospectus, Kent shares stated that my country’s high-performance engineering plastic parts market size was 23.736 billion yuan in 2016, and the market size has reached 31.906 billion yuan in 2021, with an average annual compound growth rate of 6.09% from 2016 to 2021. According to predictions, my country’s high-performance engineering plastic parts market will grow to 47.005 billion yuan in 2027, and the average annual compound growth rate from 2021 to 2027 is expected to be 6.67%, maintaining a stable growth trend.

In terms of market geographical distribution, my country’s high-performance engineering plastic parts market shows a relatively obvious regional concentration distribution feature, with a strong industrial cluster effect. From a regional perspective, my country’s high-performance engineering plastic parts market is mainly distributed in East China and South China. The market shares of the two regions in 2021 will be 32.48% and 21.67% respectively, which together exceed 50% of the national market share.

微信扫一扫打赏

微信扫一扫打赏