MLCC localization accelerates, MLCC release film market has broad development space

MLCC release film is an important material for the production of MLCC. PET polyester film is usually used as the base film, and the surface of the base film is coated with a silicone coating. MLCC release film is mainly used in the casting process to carry the clay layer. As the core consumable of MLCC, in recent years, as the localization of MLCC accelerates, the market demand for MLCC release film has continued to increase.

MLCC release film is a highly consumable product produced by MLCC. The release film consumed in producing a single layer of MLCC is roughly equal to the area of MLCC. MLCC release film is a high-end release film product. Due to the high manufacturing requirements of MLCC, in order to ensure uniform coating of ceramic slurry, MLCC release film must have high flatness, high tensile strength, low roughness, and high slurry adaptability. , no foreign body spots and other requirements. And as the number of MLCC layers increases and the miniaturization trend emerges, the performance requirements of MLCC release films will further increase.

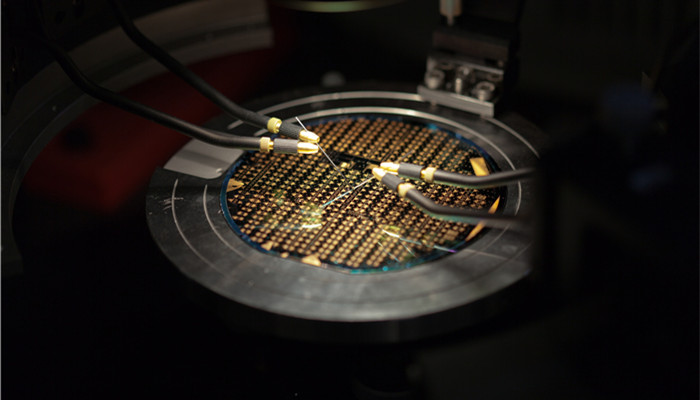

MLCC, a chip multilayer ceramic capacitor, is one of the most commonly used basic electronic components in industry. MLCC is widely used in automobiles, military industry, 5G, consumer electronics, household appliances and other fields. From 2019 to 2021, driven by terminal demand, the global MLCC market continued to expand, with an average annual compound growth rate of more than 18.0%. In 2021, the global The MLCC market size is 115 billion yuan, with shipments of approximately 5.2 trillion units. The MLCC market is developing rapidly, and the market demand for MLCC release films is growing rapidly.

According to the “2023-2027 China MLCC Release Film Industry Market In-depth Research and Development Prospects Forecast Report released by the Industrial Research Center , the MLCC release film market is highly concentrated, with Japanese, Korean and other companies occupying major shares of the global market, such as Toray, Teijin, Mitsubishi Chemical, Mitsui Chemicals and other companies. my country’s MLCC release film suppliers include Shuangxing New Materials, Zhejiang Jiemei Electronic Technology, Kanghui New Materials, etc. Domestic MLCC release film production capacity is mainly concentrated in the mid-to-low-end field, and demand for high-end products still relies on imports.

The MLCC market is relatively concentrated, and the high-end field is dominated by foreign companies such as Murata and Samsung Electro-Mechanics. MLCC has a wide range of application fields. In order to meet the ever-released domestic market demand, the localization process of MLCC has been accelerated. In recent years, MLCC companies including Yuyang Technology, Fenghua Hi-Tech, Sanhuan Group and Weicong Technology have expanded production. The continuous expansion of the domestic production scale of MLCC will provide broad space for the development of the MLCC release film market. Domestic MLCC release films are expected to occupy more market shares by virtue of their advantages in cost, drive, and localization.

Industry analysts said that benefiting from the development of military industry, 5G, automotive electronics, consumer electronics and other industries, the scale of the global MLCC market continues to rise. As the core consumable for MLCC production, the market demand for MLCC release film will grow accordingly. The MLCC release film market is highly concentrated, with foreign companies occupying a major share of the global market. However, as the localization of MLCC accelerates and domestic companies improve their R&D capabilities, domestic MLCC release films will develop towards large-scale and high-end development.

微信扫一扫打赏

微信扫一扫打赏