The microfiltration membrane market continues to grow and PVDF becomes the mainstream membrane material

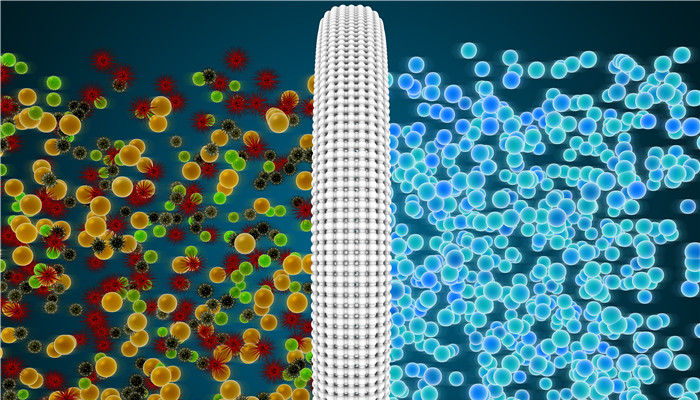

Microfiltration (MF) is a membrane separation process driven by pressure difference. Its mass transfer mechanism is that the membrane sieves according to the particle size of the substances contained in the liquid, thereby achieving the separation of particles of different sizes.

The pore size range of microfiltration membrane is 0.02-1.2μm, and its interception methods generally include mechanical interception on the membrane surface, adsorption interception in the membrane pores, bridging interception, and electrostatic interception when the membrane material is charged. Microfiltration membranes have larger pore sizes and are mainly used to intercept suspended solids, bacteria and some large-scale colloids in industrial wastewater treatment. Under deeper separation requirements, microfiltration is often used as a pretreatment process for other separation processes.

Industrial Research Center issued the 2022 Global and Chinese Micro “Filtration membrane industry in-depth research report” shows that the global microfiltration membrane market size will grow from US$1.31 billion in 2022 to US$1.95 billion in 2027, with a compound annual growth rate of 8.3%. The overall growth in demand for microfiltration membranes in the water treatment segment and the increasing water shortage are driving the global microfiltration membrane market. Increasing environmental concerns and government regulations on wastewater treatment are also driving the demand for microfiltration membranes. .

Based on raw material type, fluorinated polymers may be the fastest growing segment of the entire microfiltration membrane market

Fluorinated polymers are the most widely used microfiltration membrane products in the market. Fluorinated polymers include materials such as polyvinylidene fluoride (PVDF) and polytetrafluoroethylene (PTFE). PVDF is the most commonly used material for constructing microfiltration membranes. It has excellent chemical resistance, high hydrophobicity, mechanical strength and good processing properties. PVDF membranes have the best chemical and chlorine durability among all commercial membranes.

Based on filtration mode division, the cross-flow filtration mode segment is estimated to be the fastest growing segment in the entire microfiltration membrane market

Cross-flow filtration mode is the mainstream filtration mode in the current market. In cross-flow filtration, the feed to be filtered is continuously tangentially recirculated to the filtration membrane surface, so membranes with cross-flow filtration mode reduce the chance of contamination of membrane performance, thus improving membrane performance.

Based on application, water treatment will be the largest demand market for microfiltration membranes

Water treatment will be the largest demand market for microfiltration membranes, which are widely used in water and wastewater treatment applications due to their excellent properties, such as high durability and strength, water permeability, and heat and chemical resistance. Growing demand for clean water, environmental concerns, and strict government regulations on water quality have led to increased consumption of microfiltration membranes in water treatment applications.

Major competitors in the global microfiltration membrane market include SUEZ (France), Merck KGaA (Germany), Sartorius AG (Germany), Koch Separation Solutions (US), Hydranautics (US), Pall Corporation (US), 3M (US) , Pentair (UK), Asahi Kasei Corporation (Japan) and Toray Industries Inc. (Japan).

微信扫一扫打赏

微信扫一扫打赏