Policies continue to increase, and domestic substitution of photoresist will be the general trend.

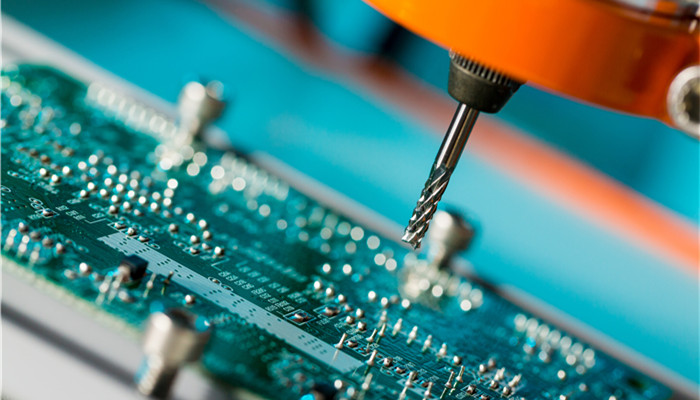

Photoresist, also known as photoresist, is an organic compound whose main components are photoinitiators, solvents, monomers, photoresist resins, additives, etc. There are many types of photoresists. According to different application fields, photoresists can be divided into three types: PCB photoresist, LCD photoresist, and semiconductor photoresist. Among them, semiconductor photoresists have higher production barriers, and subdivided products include i Line, g-line, KrF, ArF, EUV, etc., among which EUV photoresist is the most advanced photoresist product. Photoresist is the core material of the photolithography process. In recent years, with the development of my country’s electronic information industry, the market demand for photoresist has been continuously released.

According to the “2022-2026 Photoresist Industry Market In-depth Research and Investment Prospects Forecast Analysis Report released by the Industrial Research Center, In recent years, the global photoresist market has maintained a growth trend. In 2020, the global photoresist market size will be approximately US$9.5 billion. The photoresist market has broad development space. It is expected that the global photoresist market will maintain an average annual compound growth rate of 5.6% from 2022 to 2026.

Thanks to the eastward shift of PCB, LCD, semiconductor and other industries, the growth rate of my country’s photoresist market has accelerated. In 2020, the scale of my country’s photoresist market has reached 8.5 billion yuan. my country is the world’s largest producer of electronic products and has a large domestic demand for photoresist. It is expected that from 2022 to 2026, my country’s photoresist market will maintain a growth rate higher than the global average.

Photoresist technology barriers are high and the global market is relatively concentrated. Among them, Japanese and American companies such as Japan Synthetic Rubber (JSR), Shin-Etsu Chemical, Tokyo Chemical Industry (TOK), and DuPont of the United States dominate the global photoresist market. Japanese photoresist technology is at the leading international level, especially in the high-end EUV photoresist market, which is almost a monopoly. At present, my country’s low-end photoresists have basically achieved domestic substitution, but high-end photoresists are still highly dependent on imports, especially EUV photoresists.

Photoresist is a key material for electronic processing. In the context of the intensifying trade conflict between China and the United States, the security and independent controllability of the photoresist industry chain are particularly important. In recent years, the Chinese government has issued a number of favorable policies to support the development of the photoresist industry. At the same time, domestic companies are also actively developing mid-to-high-end products and actively seeking to localize photoresist and its core materials. At this stage, my country’s photoresist companies include Jingrui Electric Materials, Tongcheng New Materials, Chinachem Technology, Nanda Optoelectronics, etc. With the great opportunity of domestic substitution, domestic photoresist companies will usher in good development opportunities.

Industry analysts said that photoresist is widely used in semiconductors, displays, panels and other fields. my country is a major producer of electronic products. The market demand for resist is vast, but due to technical limitations, my country’s high-end photoresist supply capacity is insufficient, and market demand still relies on imports. The security, autonomy and controllability of the photoresist industry chain are particularly important. With policy support, technological empowerment, and corporate help, domestic substitution of photoresist will be the general trend.

微信扫一扫打赏

微信扫一扫打赏